The Magic of “Beneficial Owner” under China’s Tax Treaties

The Magic of “Beneficial Owner” under China’s Tax Treaties

The determination of "beneficial owner" is a decisive but complicated process in the application for tax treaty benefits.

The concept of "beneficial owner" under the Chinese tax regime

The concept of "beneficial owner" under the Chinese tax regime can be traced back to as early as 1983, when China entered into its first tax treaty with Japan. Since then, the wording of "beneficial owner" has been included in virtually every tax treaty that China has concluded. As of November 2016, China had established quite a broad tax treaty network with 102 jurisdictions, plus tax arrangements with Hong Kong ("HK"), Macau and Taiwan (not effective yet)

(http://www.chinatax.gov.cn/n810341/n810770/index.html).

However, until recent years Chinese tax authorities and practitioners have begun to scrutinize this fundamental concept of tax treaty regime.

In October 2009, the State Administration of Taxation ("SAT") promulgated the Notice on the Interpretation and Determination of "Beneficial Owner" under Tax Treaties ("Notice 601"). According to Notice 601, "beneficial owner" is defined as a person (including an individual, an enterprise or any other entity) that holds the ownership of and right of control on the relevant income or properties/rights which generate such income. The "beneficial owner" should generally be engaged in substantive operations, which include manufacturing, sales, management, etc. Notice 601 specifically excludes agents and conduit companies from the scope of "beneficial owner".

As a further interpretation, the SAT also promulgated a follow-up notice ("Notice 30") in June 2012 to supplement factors and criteria for determining "beneficial owner" under tax treaties.

The relevant factors and evidence forms

As a general comment, all the relevant factors shall be considered and analyzed as a whole. In addition to analysis from a technical perspective or a domestic legal perspective, the purpose of the applicable tax treaties shall also be considered and the principle of "substance over form" shall be observed.

The following situations are specially set forth by Notice 601 as unfavorable factors in determining the status of "beneficial owner" under tax treaties:

- The applicant has an obligation to pay or distribute all or a majority part (e.g. over 60%) of the relevant income to a resident in a third jurisdiction within a prescribed time limit (e.g., within 12 months after receiving the income).

- The applicant has no or few operation activities other than holding the properties or rights that generate the relevant income.

- Where the applicant is an entity, the scale of asset, operations or employees of the applicant does not match with the amount of the relevant income.

- The applicant has no or little right of control or disposal on the properties or rights that generate the relevant income and bears no or few risks associated with such properties or rights.

- The counterparty of the applicable tax treaty (i.e., the home jurisdiction of the applicant) does not impose tax or grants tax exemption on the relevant income, or the actual tax rate is very low.

- Where the nature of relevant income is interest or royalty, there are back-to-back loan/licensing agreements between the applicant and other parties in addition to the agreements which generate the relevant income from China.

When analyzing the relevant factors, the following forms of evidence will be considered depending on the nature of the relevant income (non-exhaustive list):

- articles of association

- financial statements

- records of capital flows

- minutes of board of directors

- allocation of manpower and material resources

- allocation of functions and risks

- records of costs and expenses

- loan agreements

- licensing agreements or transfer agreements (in relation to technologies, patent, trademarks, etc.)

- patent/copyright registration certificates; and

- agent agreements or designated collection agreements

The "safe harbor" rules

Notice 30 has provided a set of "safe harbor rules" for the determination of "beneficial owner". Where an applicant that receives dividends from China is (1) a company listed in the counterparty of an applicable tax treaty; or (2) 100% directly or indirectly owned by a company that is a tax resident of and also listed in the counterparty of an applicable tax treaty (without an intermediary holding company incorporated in a third jurisdiction in between), the status of "beneficial owner" of such applicant can be directly determined.

Special provisions related to the implementation of mainland China-HK tax arrangement

The provisions of mainland China-HK tax arrangement have provided most preferential terms among treaties of China’s global network. The SAT, after consultations with the Inland Revenue Department of HK, circulated certain opinions (Shui Zong Han [2013] No. 165) regarding the implementation of the mainland China-HK tax arrangement in 2013.

According to the SAT’s opinions, the investment activity by holding the properties or rights that generate the relevant income is also considered as a type of "substantive operation activity", which will be helpful in the determination of "beneficial owner" and the application for tax treaty benefits.

Specifically, the SAT confirms that the territorial source principle of taxation adopted by HK (i.e., not imposing tax on non-HK sourced income) shall not be considered as an unfavorable factor in the determination of "beneficial owner".

However, it is not clear whether such options can also be applicable to tax treaties between China and other jurisdictions. Doubtfully, applicants from other jurisdictions that also adopt a territorial source principle of taxation may not directly cite the SAT’s above opinions as legal basis for claiming the status of "beneficial owner".

In addition, as a matter of Chinese characteristics, the SAT’s above opinions were issued in the form of public response to seven local tax authorities at provincial or municipal levels. As such, it would be even questionable whether these opinions can have binding effect outside the seven provinces and municipalities in China.

which will enable such Australian law firm to provide both Australian and Chinese legal services through a commercial presence in China.

The Henan case (2017)

Recently, a municipal-level tax bureau in Henan Province has published a case which is related to the determination of "beneficial owner" status under the mainland-HK tax arrangement.

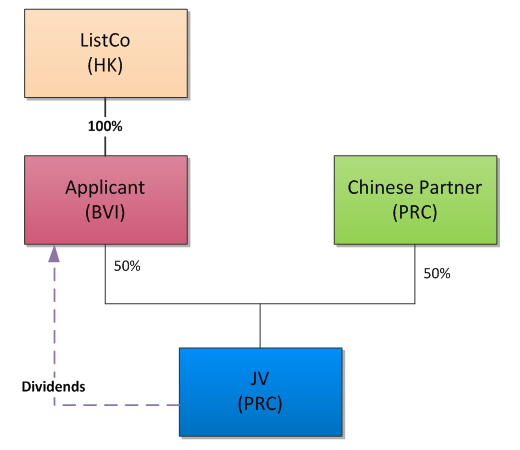

The background is illustrated as follows:

The local government made certain compensation to the PRC JV due to changes in a highway concession agreement. The PRC JV then distributed such compensation to the Applicant and the nature of the distribution was considered as dividends.

The Applicant is a company incorporated in the British Virgin Islands ("BVI") with its place of actual management located in HK. The Applicant is 100% directly owned by ListCo, which is a tax resident in HK and also listed in HK. In addition, there is no other intermediary holding company incorporated in a third jurisdiction in between. Therefore, the situation has met the conditions for the "safe harbor rules" stipulated in Notice 30.

Finally, the BVI-incorporated Applicant was considered as a "beneficial owner" under the mainland China-HK tax arrangement. The dividends distributed by the PRC JV to the Applicant were then subject to a preferential withholding tax rate (5%) reduced from the standard rate of 10%.

The Qinghai case (2014)

In a case published by the SAT in 2014, the SAT denied the status of "beneficial owner" of a Barbados-incorporated enterprise under the PRC-Barbados tax treaty.

The background is illustrated as follows:

The Applicant is a company incorporated in Barbados; however, the SAT denied its status of "beneficial owner" under the PRC-Barbados tax treaty (which means a preferential withholding tax of 5% on dividends) due to comprehensive considerations and analysis of the following factors:

- The Applicant did not have substantive operation activities other than holding the investment in the PRC JV.

- The amount of registered capital of the Applicant from 2008 to 2010 was only US$1 and its initial investment into the PRC JV was funded by loans from its parent company.

- The Applicant had five directors, but the amount of directors’ remuneration was at a nominal level (less than US$1,000 for each director per year). In addition, the Applicant did not have records of paying salaries to its employees.

- Evidences indicated that relevant responsibilities that the Applicant should bear with respect to the PRC JV (e.g., personnel recruitment, training, financing, etc.) were actually performed by the Applicant’s parent company. In addition, technical fees and service fees collected by the Applicant from the PRC JV were entirely re-distributed to the Applicant’s parent company, which tended to suggest that the Applicant was merely a collection agent.

- The applicable income tax rate for the Applicant in Barbados is in the range from 1% to 2.5% and the Applicant did not actually pay any income tax for the period from 2004 till 2010.

After considering the above factors, the SAT finally decided that the Applicant should not be considered as a "beneficial owner" under the PRC-Barbados tax treaty and therefore cannot enjoy the relevant tax treaty benefits.

A brief conclusion

It is generally considered that Chinese tax authorities have significantly strengthened the scrutiny in reviewing applications for tax treaties benefits, in particular, when determining whether the applicant has the legitimate status of "beneficial owner" under the applicable tax treaty. The determination process has become a comprehensive analysis of all the relevant factors instead of any particular item.

Foreign investors that intend to be recognized as "beneficial owners" and thus enjoy relevant tax treaty benefits are advised to get prepared and adjust the business model (if necessary) well in advance of the application.

This article is only for the purpose of communication and does not constitute a formal legal opinion. It may not be relied on for any business decisions or legal actions.