重塑格局:《加拿大投资法》修正案对加拿大矿业投资的影响

重塑格局:《加拿大投资法》修正案对加拿大矿业投资的影响

在一个全球化快速发展、国际关系复杂的时代,国家政策在塑造外国投资环境方面的作用变得越来越关键。作为加拿大经济政策的基石,《加拿大投资法》目前正在通过C-34号法案(“《修正案》")进行重大修订。这些修订是《加拿大投资法》自2009年以来最重大的修订。将可能会重新规范外国投资者,特别是中国投资者的投资领域。本文将深入研究 《加拿大投资法》《修正案》的细微差别,及其对中国投资方(尤其是对于矿业投资)的潜在影响。

In an era marked by rapid globalization and complex international relations, the role of national policies in shaping foreign investment landscapes has become increasingly pivotal. The Investment Canada Act (ICA), a cornerstone of Canada's economic policy, is undergoing significant amendments through Bill C-34. These amendments, the most substantial since 2009, are poised to redefine the terrain for foreign investors, particularly from China. This essay delves into the nuances of the proposed changes to the ICA and their potential ramifications on Chinese investments with a focus on the mining sector.

《加拿大投资法》的背景

Background of the Investment Canada Act

1985年颁布的《加拿大投资法》创设了一个用于审查和核准外国在加拿大投资的法律框架。该法的主要任务是确保外国投资为加拿大带来“净收益",同时保持经济发展与国家利益之间的平衡。

Enacted in 1985, the ICA was established as a framework to review and approve foreign investments in Canada. Its primary mandate was to ensure that foreign investments provided a 'net benefit' to Canada, balancing economic opportunities with national interests.

自颁布以来,《加拿大投资法》经历了数次修订,每一次修订都紧随全球经济政策风向的演变,同时也能反映出加拿大在全球经济政策中的角色。最初,该法修订的重点主要集中在确保经济增长和资本流入;然而,随着全球形势的变化,该法修订的重点转向了保护敏感部门和维护国家安全:2009年的修订赋予了加拿大政府审查外国投资是否涉及潜在国家安全问题的权力。修订重点的趋势变化是由对国有企业以及来自具有不同管理模式国家(如中国)的实体投资的安全考虑所驱动的,该修订要求对国家安全至关重要的领域(如电信、国防、技术和关键矿物)的投资进行更加严格的审查。

Over the years, the ICA has seen several revisions, each reflecting the changing tides of global economic policies and Canada's position within them. Initially, the focus was largely on economic growth and the influx of capital; however, as global dynamics shifted, the emphasis moved towards protecting sensitive sectors and preserving national security with amendments in 2009 giving the Canadian government the ability to review foreign investments for potential national security concerns. This evolution in focus has been partly driven by rising concerns over investments by state-owned enterprises (SOEs) and entities from countries with differing governance models, such as China, leading to increased scrutiny of investments in sectors deemed critical to national security, such as telecommunications, defense, technology, and critical minerals.

《加拿大投资法》的现状

Current ICA Situation

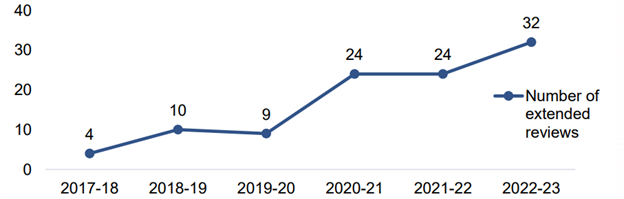

《2022-2023年度加拿大投资法实施报告》(“《实施报告》")全面阐述了加拿大对于外国投资的应对思路[1]。《实施报告》中不仅包括外国投资者关于新设、收购控制权的企业数量,还涵盖了国家安全审查次数的数据。数据表明延期国家安全审查(Extended National Security Reviews)数量呈稳定增长的趋势:从2017-2018年度的4次增加到2022-2023年度的32次。值得注意的是2022-2023年度的审查中,共有五次针对中国自然资源企业的延期国家安全审查。延期国家安全审查只有在创新、科学和工业部部长(“部长")决定更为审慎地审查一项外国投资交易时才会发生。延期国家安全审查案例数的上升反映了加拿大政府对于外国投资更大的关切,也多是加拿大政府对于某些类型投资态度的政治风向标。

The 2022-2023 Annual Report on the administration of the ICA offers a comprehensive overview of Canada's approach to foreign investment. Among other things, the 2022-2023 Annual Report includes data on the number foreign investors establishing businesses or acquisitions of control and the number of national security reviews. The data shows the steady trend of an increasing number of extended national security reviews, increasing from 4 extended national security reviews in 2017-2018 to 32 in 2022-23. 2022-2023 included five extended national security reviews against Chinese natural resource companies. Extended national security reviews occur when the Canadian Minister of Innovation, Science and Industry (Minister), who is responsible for administering the national security provisions of the ICA, decides to review a foreign investment transaction in detail. The increasing number of extended national security reviews is therefore indicative of an increasing interest by the Minister of foreign investments into Canada and is generally indicative of the overall political momentum against certain types of foreign investment into Canada.

图1:延期国家安全审查的数量统计

Figure 1: Number of Extended National Security Reviews

2022-2023年度中国自然资源公司企业收到的五次延期国家安全审查中,三家中国矿业公司收到了要求其出售在加拿大上市公司股权的强制令,而另外两家矿业公司在完成交易前撤回了申请。可以说,接受延期国家安全审查的中国矿业公司均未能继续完成其交易[2]。

Among the extended national security reviews that Chinese natural resource companies received in the 2022-23, three Chinese mining companies received divesture orders requiring them to sell their interests in Canadian publicly listed companies . The other two mining companies withdrew their application before completing their transactions. In conclusion, no Chinese mining companies that were subject to an extended national security review were able to complete their transactions.

这一趋势表明,加拿大政府更倾向于运用《加拿大投资法》中的国家安全审查条款审查中国公司,尤其是矿业领域的公司。对《加拿大投资法》的修订《修正案》将赋予部长更大的审查交易的权力,这可能使中国企业在加拿大矿业领域的投资更加困难。

The trend shows the Minister’s willingness to wield the national security review provisions of the ICA, with a particular focus on Chinese companies, especially in the mining sector. The proposed amendments to the ICA will give more power to the Minister to review transactions and likely make it more difficult for Chinese companies to make investments in the Canadian mining sector.

《修正案》概述

Overview of Proposed Amendments

此次由加拿大下议院提出的《修正案》将对《加拿大投资法》进行重大变革,体现加拿大政府在管理外国投资方面的战略转变[3]。该法案包括多项关键修订,目的在于加强对外国投资的监督和管理(尤其是在涉及国家安全的情况下)。值得注意的是,对《加拿大投资法》的修订将适用于已在进行的审查程序。

Bill C-34, introduced in the Canadian House of Commons, proposes transformative changes to the ICA, indicating a strategic shift in Canada's approach to managing foreign investments. The bill encompasses several key amendments aimed at strengthening the oversight and management of foreign investments, particularly in the context of national security concerns. The changes to the ICA will apply to any review processes already underway.

新的备案要求——最显著的变化之一,是对某些特定商业领域的投资引入了新的备案要求。这一修订旨在提高政府对投资的早期审查力,特别是对国家安全或经济稳定至关重要的领域的投资。通过对事先备案的要求,政府旨在防止可能危及加拿大战略利益的投资情况。

New Filing Requirements - One of the most notable changes is the introduction of new filing requirements for investments in certain prescribed business sectors. This amendment aims to increase the government's ability to scrutinize investments at an earlier stage, particularly those in sectors considered vital to the national security or economic stability. By requiring prior filing, the government seeks to prevent situations where investments could potentially compromise Canada's strategic interests.

延长审查权——另一个重要修订是赋予部长延长投资国家安全审查的权力。这一变化反映了对复杂投资全面评估的意识,尤其是涉及敏感技术或数据的投资,需要更多时长来评估其对国家安全的潜在风险和影响。延长的审查期为政府全面审查和评估外国投资提供了更健全的框架。

Extended Review Authority - Another significant aspect of the amendments is the extended authority granted to the Minister to prolong the national security review of investments. This change reflects an understanding that thorough assessments of complex investments, especially those involving sensitive technologies or data, require more time to evaluate the potential risks and implications for national security. This extended review period provides the government with a more robust framework to scrutinize and assess foreign investments thoroughly.

加重对违规行为的处罚——《修正案》还增加了对违反《加拿大投资法》规定的行为的处罚。这一举措反映了更严格的监管立场,旨在确保外国投资者严格遵守《加拿大投资法》制定的规则和指引。加重处罚旨在威慑潜在的违法行为,并表明政府严格执行《加拿大投资法》条款的决心。

Enhanced Penalties for Non-Compliance - The proposed amendments also introduce enhanced penalties for non-compliance with the Act’s provisions. This move is indicative of a stricter regulatory stance, aiming to ensure that foreign investors adhere closely to the rules and guidelines set forth by the ICA. The increased penalties serve as a deterrent against potential violations and signal the government's commitment to enforcing the ICA’s provisions rigorously.

部长对临时条件的裁量权——《修正案》还授予部长在国家安全审查期间自由设定条件的权利。这一规定使得投资管理方法更加灵活且具有更快的响应能力,有助于政府在审查过程中消除发现的潜在风险。设定临时条件的权力确保了在国家安全构成威胁的情况下,投资必须经审查才能继续进行。

Ministerial Discretion for Interim Conditions - Further, the bill grants the Minister the discretion to impose conditions during a national security review. This provision allows for a more dynamic and responsive approach to managing investments, enabling the government to mitigate potential risks as they are identified during the review process. The ability to impose interim conditions ensures that investments do not proceed unchecked if they pose a risk to national security.

对国家安全风险的承诺——《修正案》还扩大了外国投资者可能需要承担的条件或承诺的范围,以减轻其在国家安全方面的担忧。这些承诺可能包括比以前更严格的措施,例如加强运营监督、限制接触敏感技术或保证维持某些加拿大商业惯例。

Undertakings for National Security Risks - These amendments expand the scope of conditions or commitments that foreign investors may be required to undertake to mitigate national security concerns. These undertakings could involve more stringent measures than previously required, such as enhanced oversight of operations, restrictions on access to sensitive technologies, or assurances to maintain certain Canadian business practices.

国际信息共享机制的优化——此外,《修正案》将对国际信息共享机制的进行优化。这一举措主要应对许多投资实体具有全球性质,以及国际合作对于有效评估和管理风险的重要性。通过加强信息共享机制,加拿大政府可以更好地理解某些投资领域的更广泛影响,以便做出更合理的决策。

Improved International Information Sharing - Additionally, the amendments facilitate improved international information sharing. This enhancement acknowledges the global nature of many investment entities and the importance of collaborating with international counterparts to assess and manage risks effectively. By strengthening information-sharing mechanisms, Canada can better understand the broader implications of certain investments and make more informed decisions.

司法管辖权的延伸——最后,《修正案》将会使得《加拿大投资法》的管辖范围扩展到任何加拿大企业所拥有的资产上。这可能被解释为包括加拿大企业直接或者间接拥有的全部资产,包括那些位于加拿大境外的资产。该等延伸目的在于打压通过加拿大海外子公司实施的交易,而该等交易目前并不在《加拿大投资法》的规制范围内。

Extending Jurisdictional Authority – Finally, the amendments will result in ICA jurisdiction being extended to cover all assets owned by a Canadian business. This is likely to be interpreted as including all assets owned directly or indirectly by the Canadian business, even those located outside of Canada. This extension aims to clamp down on transactions conducted with oversea subsidiaries of Canadian companies that are currently outside the scope of the ICA.

《修正案》对中国投资方的影响

Impact of Amendments on Chinese Investments

我们预计,《修正案》中提出的修订预计将可能显著改变中国在加拿大的投资格局。这些变化预示加拿大可能将走向更严格的审查和监管,体现了地缘政治风险促使跨境投资审查收紧的趋势。《修正案》的一个主要影响是增加了对国有企业,尤其是中国国有企业的审查。从加拿大政府的角度,中国国有企业常常被描述为具有与中国广泛的经济和地缘政治目标相同的战略目标,这引起了加拿大对外国国家主体在关键经济领域影响力的关注。因此该等投资将会从多个角度被审视:虽然它们带来资本、技术和就业,但也可能引发加拿大政府关于对自然资源的控制、技术转让和保护关键基础设施的担忧。新的备案要求和延长的审查权限意味着中国国有企业的投资将接受更严格的审查。这可能导致投资流程的延迟,也可能拒绝国有企业进行某些被认为是敏感或有争议的投资。因此,加拿大政府管理这些投资的方式不仅反映了其经济上的考量,也反映了其对于国际关系和国家安全的相互作用的考量。

The amendments proposed in Bill C-34 are poised to significantly reshape the landscape for Chinese investments in Canada. The changes signal a move towards greater scrutiny and regulation, aligning with the trend of geopolitical risks prompting tightened cross-border investment reviews. One of the primary impacts of the amendments is the increased scrutiny of SOEs, especially from China. From the Canadian perspective, SOEs are often portrayed as operating with strategic objectives aligned with China's broader economic and geopolitical goals, which has raised concerns in Canada regarding the influence of foreign state actors in critical sectors of the economy. The investments have been viewed through various lenses: while they bring capital, technology, and jobs, they also may pose concerns about control over natural resources, technology transfer, and the safeguarding of critical infrastructure. The new filing requirements and extended review authority mean that investments by Chinese SOEs will undergo more rigorous examination. This could lead to delays in investment processes and may deter some SOEs from pursuing certain investments, especially those perceived as sensitive or controversial. The Canadian government's approach to managing these investments, therefore, reflects not only economic considerations but also the interplay of international relations and national security concerns.

国家安全机制范围的扩大将可能使更多的中国投资受到审查。即使是曾被认定为风险较低的投资现在也有可能触发审查,尤其是涉及敏感技术、关键基础设施或数据的投资。也可能会影响中国在包括采矿和电信等多个行业的投资,这些领域的投资可能被要求实施更全面的合规和风险评估策略。

The broadened scope of the national security regime will subject a wider array of Chinese investments to scrutiny. Even investments that were previously considered low-risk could now trigger reviews, especially if they involve sensitive technologies, critical infrastructure, or data. This could potentially impact Chinese investments in various sectors, from mining to telecommunications, requiring more comprehensive compliance and risk assessment strategies.

另一个重大影响是进行国家安全审查权限的扩大可能导致投资流程的延长。对于中国投资者(尤其是在科技等快速发展的行业)来说,该等延长可能是做出决策的关键因素。更长的审查期限可能会减少加拿大对时间敏感型投资的吸引力,并可能促使中国资本流向其他市场。

Another significant impact is the potential delay in investment processes due to the extended authority to conduct national security reviews. For Chinese investors, particularly in fast-moving sectors like technology, these delays could be a critical factor in decision-making. The need for longer review periods might make Canada less appealing for time-sensitive investments, potentially diverting Chinese capital to other markets.

《加拿大投资法》的修订可能会对加拿大和中国的贸易关系产生一定影响。一方面,加拿大此举与那些对外国投资采取更严格措施的盟友保持一致,特别是对来自其他国家或地区的投资。另一方面,这可能被看作是一种保护性措施,有可能改变人们对加拿大作为一个对中国投资者开放和友好市场的看法。

The recalibration of the ICA could have significant implications for Canada-China trade relations. On one hand, it aligns Canada with allies who are also adopting more stringent measures on foreign investments, especially from alternative governing jurisdictions. On the other, it could be perceived as a protective move, potentially affecting the perception of Canada as an open and welcoming market for Chinese investors.

结论

Conclusion

针对的《加拿大投资法》的《修正案》所提出的修订标志着加拿大对外国投资态度的一个关键转折点,对中国投资尤其具有重大影响。在适应这一新的监管环境时,加拿大面临着两难挑战:一方面要维持一个对外国投资开放、有吸引力的市场;另一方面又要保护其认为的国家安全和经济利益。

The amendments proposed in Bill C-34 to the ICA signify a pivotal moment in Canada's approach to foreign investments, with far-reaching implications for Chinese investments in particular. As Canada navigates this new regulatory landscape, it faces the dual challenge of maintaining an open, attractive market for foreign investment while safeguarding what it perceives as its national security and economic interests.

这些变化蕴含的潜在影响是长远的。对中国投资者来说,这些修订可能需要他们重新调整投资战略,更加强调合规性和风险评估。

The potential long-term implications of these changes are profound. For Chinese investors, the amendments may necessitate a recalibration of investment strategies, with a greater emphasis on compliance and risk assessment.

随着这些法律改革的实施,它们对中国在加拿大的投资轨迹的影响将受到密切关注。这些改变将作为全球投资领域中,经济利益和国家安全考量之间互动的重要指标。在这一变化的环境中,对外国资本欢迎态度和保护国家利益之间的平衡比以往任何时候都更加微妙,需要采取细致的战略方针。

As these legislative changes unfold, their impact on the trajectory of Chinese investments in Canada will be closely watched. They will serve as a barometer for the broader interplay between economic interests and national security considerations in the global investment arena. In this evolving landscape, the balance between welcoming foreign capital and protecting national interests is more delicate than ever, requiring nuanced and strategic approaches.

最后,对《加拿大投资法》的修订预计将促使中国投资者对加拿大采取更加谨慎和有选择性的投资策略。这些监管变化需要投资者更加周密的规划、合规,并可能需要进行投资重点的战略转移。

In conclusion, the amendments to the ICA should be expected to lead to a more cautious and selective approach by Chinese investors towards Canada. The regulatory changes will require more diligent planning, compliance, and possibly a strategic shift in investment focus.

[注]

[1] https://ised-isde. canada.ca/site/investment- canada-act/sites/default/files/attachments/2022-23-annual-report-en-v4.pdf

[2] 值得注意的是,据公开消息,其他行业的中国投资在接受延期国家安全审查后仍获得了批准。

[3] https://www.ourcommons.ca/DocumentViewer/en/44-1/INDU/report-17